3 Biggest Challenges of Rising Interest Rates on Global Banks

Expand your reach and accelerate your payments business

Deliver real-time global payments without tying up capital in destination markets.

Our proven technology and global network enable remittances, SME payments, disbursements and treasury flows that are faster, more reliable and more affordable for organizations and their customers.

Ripple enables us to create a faster settling transaction. Our b2b customers are able to get more surety and speed on transactions for their clients.

Peter Cook, CEO of Novatti

Why industry leaders choose our cross-border payments solution

Enable faster payments

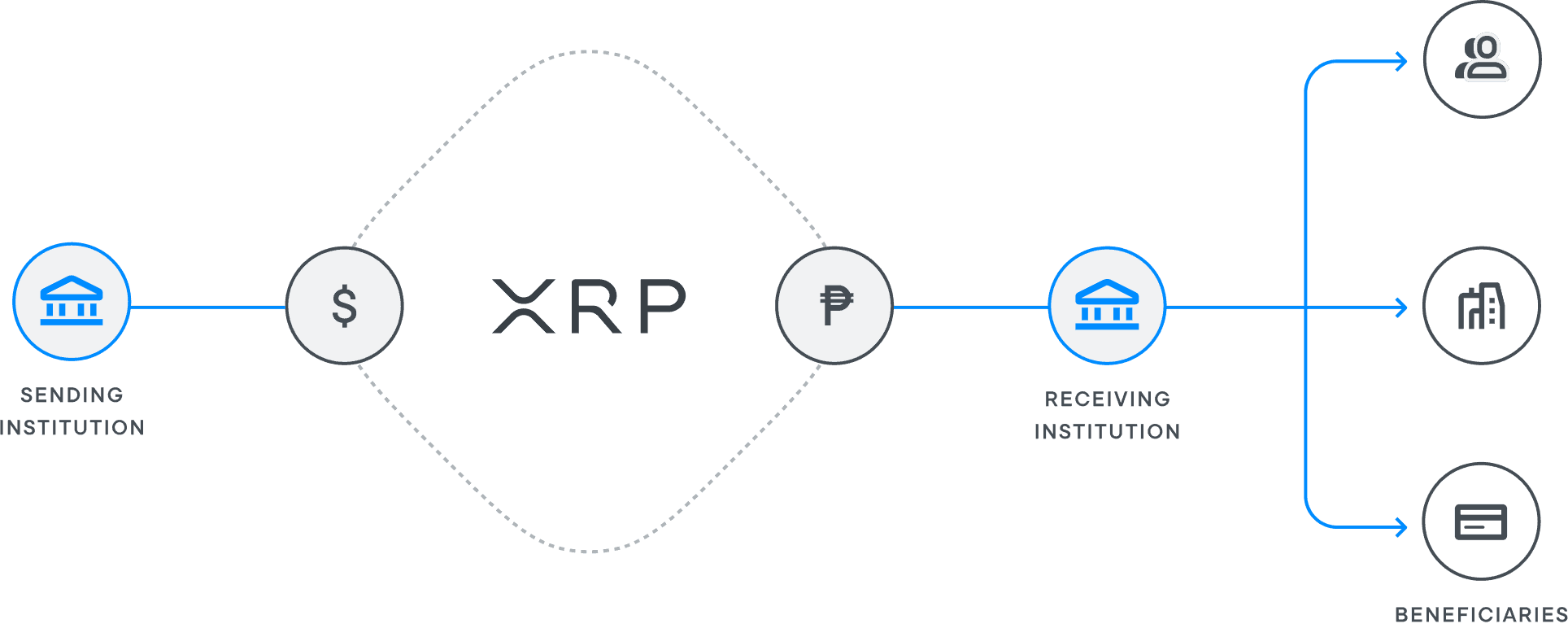

Speed up delivery regardless of funding source or destination with real-time settlement.

Expand into new markets

Easily access and connect to payout markets across the globe with one seamless integration.

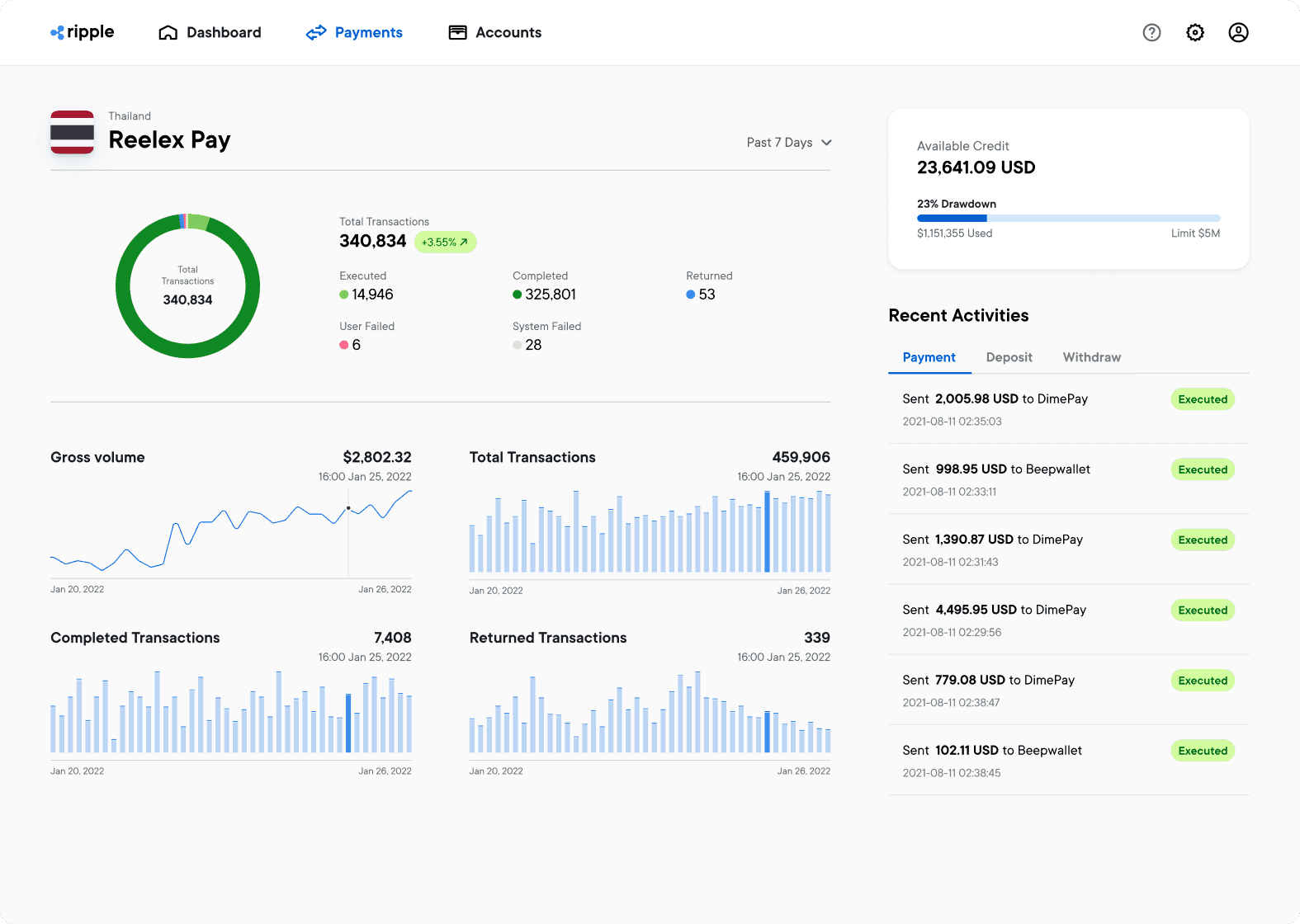

Track payments in real-time

Gain payment certainty and clarity with real-time tracking and up-front pricing.

Move money on your schedule

Effectively manage payments 24x7x365, with no cut-off times and no need for pre-funding.

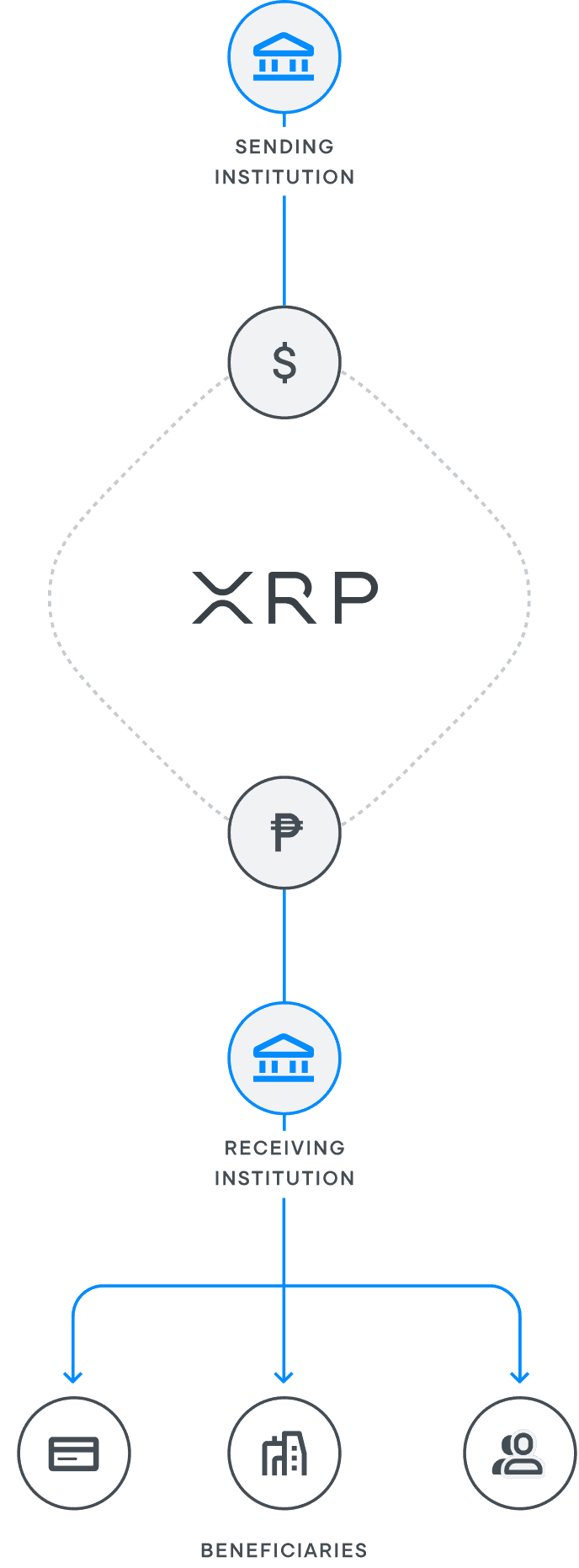

How Ripple’s cross-border payments solution works

Get best-in-class global payouts

Read the latest on Cross-Border Payments