3 Biggest Challenges of Rising Interest Rates on Global Banks

Reliable crypto liquidity to power your business operations

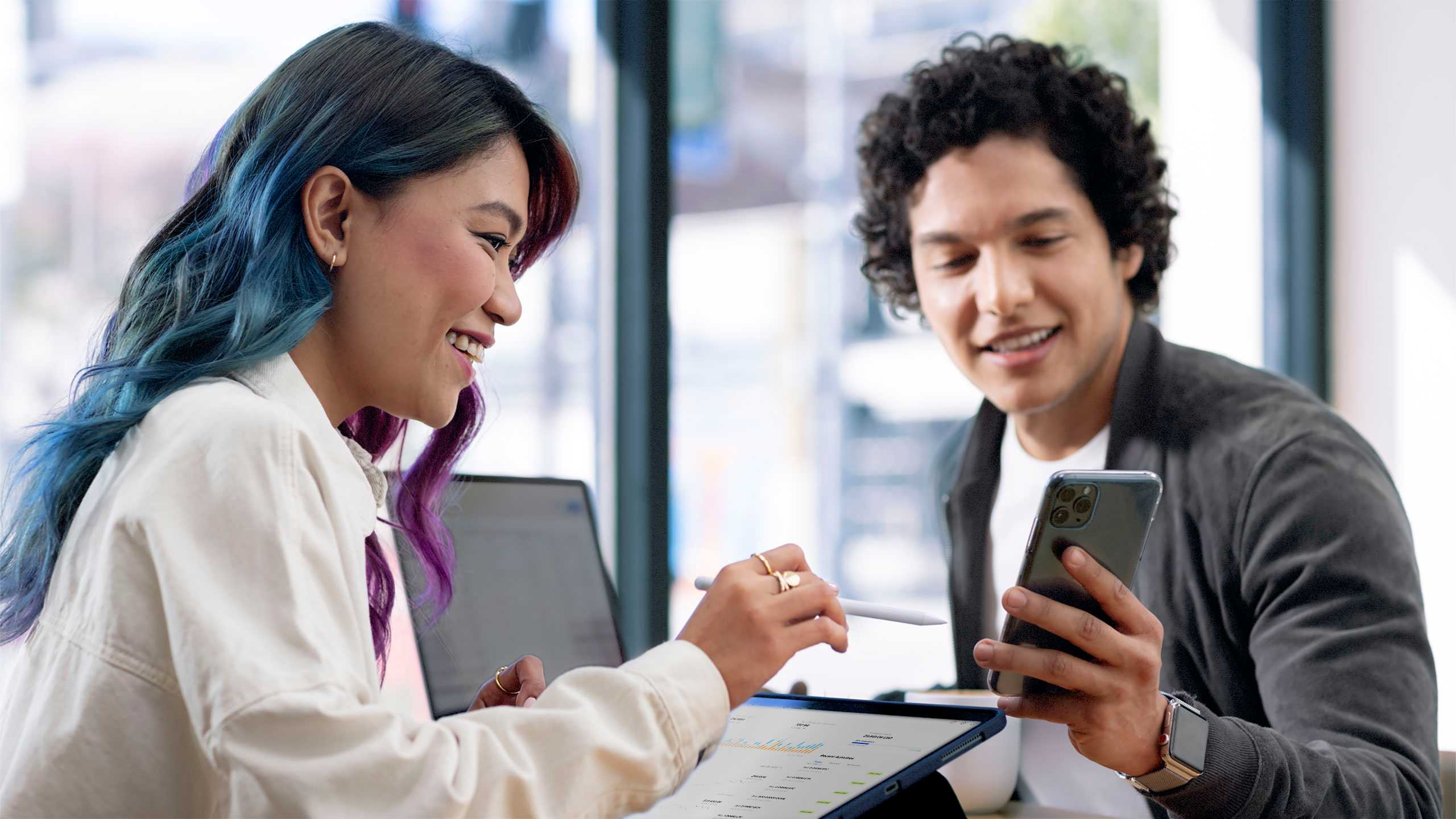

Today, businesses must leverage both digital assets and fiat to fuel their operations and need a reliable and scalable source of cost-efficient liquidity.

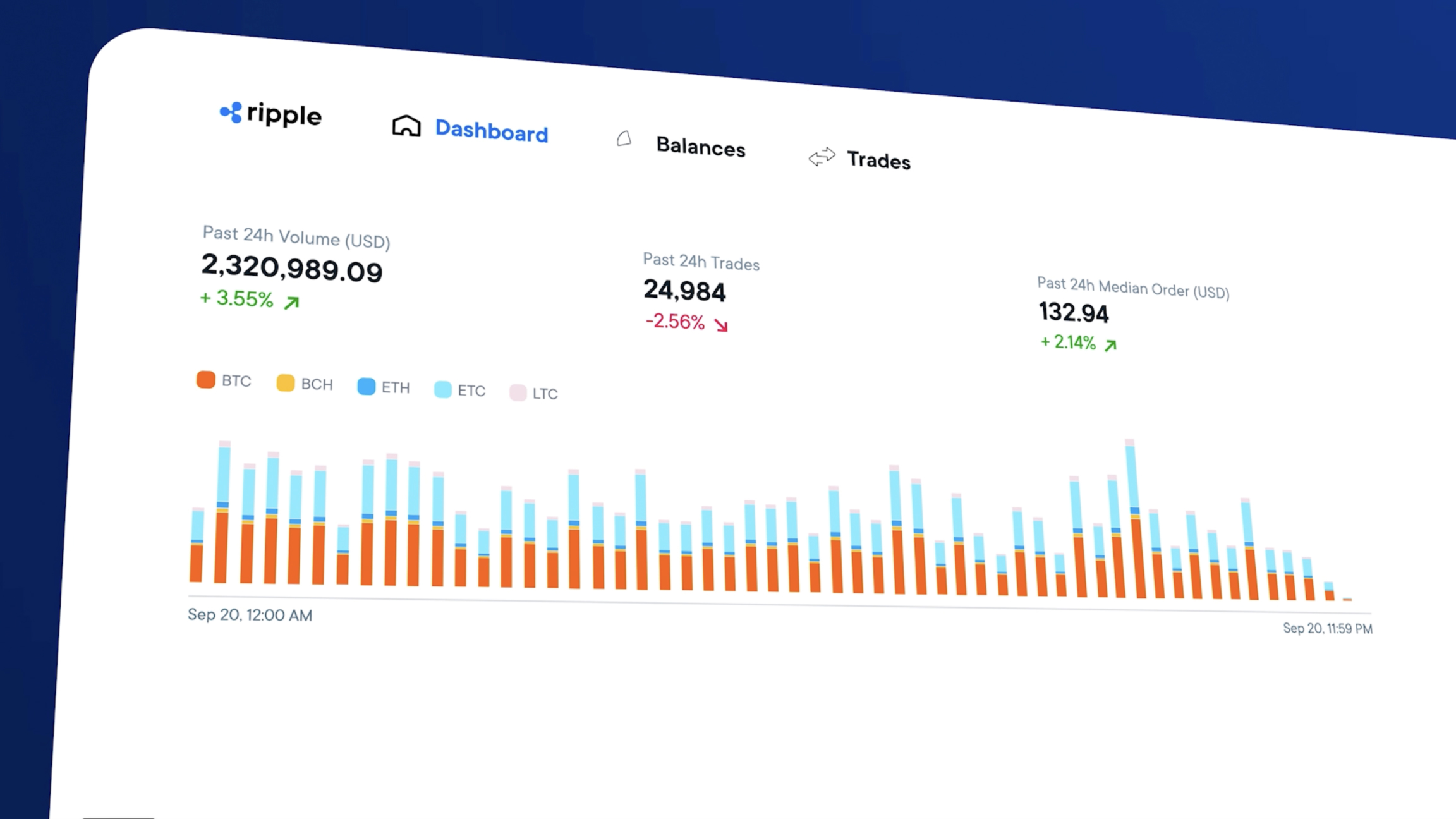

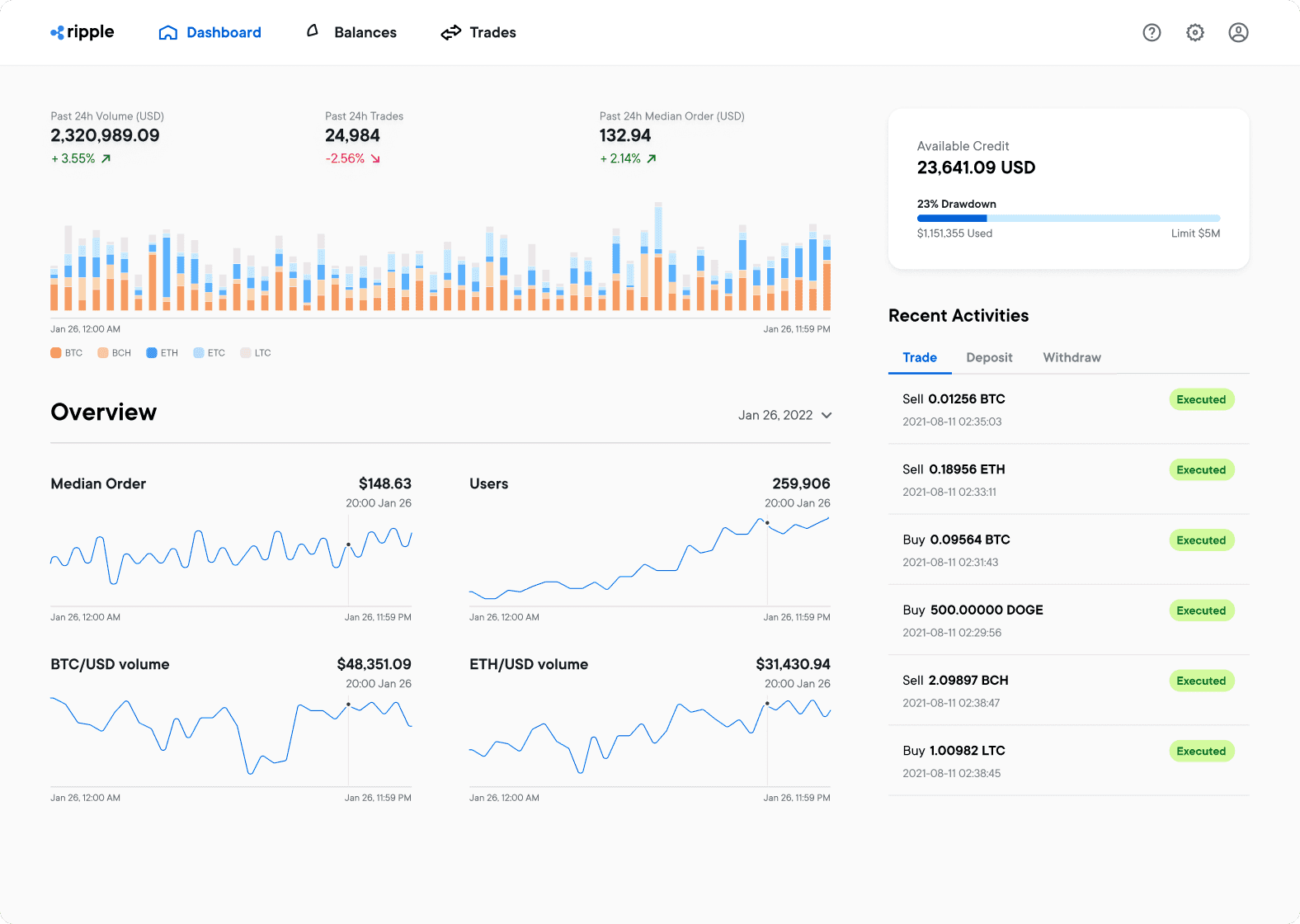

Ripple Liquidity Hub is a turn-key platform that provides businesses with a streamlined way to buy, sell and hold digital assets. Businesses can access multiple liquidity pools and advanced trading features, including post-trade settlement, all through a single-API experience.

*Ripple Liquidity Hub is available to customers in Brazil Australia, and certain US states.

Benefits of Liquidity Hub

Optimized crypto liquidity

Access aggregated liquidity pools, including exchanges and OTC desks, to get optimized pricing.

Robust customer support

Engage with a dedicated customer service team to support your company’s unique needs.

Streamlined digital asset management

Leverage an enterprise-level dashboard for managing, trading and reporting.

Expanded access to capital

Remove the need to hold pre-funded capital positions with multiple liquidity venues via our post-trade settlement feature.

How Ripple Liquidity Hub works

Liquidity Hub is a turn-key liquidity and global payout platform, built specifically for enterprise needs. It supports a variety of digital assets and connects organizations to a rich set of liquidity venues to source optimized pricing via smart order algorithms.

Read the latest on Crypto Liquidity